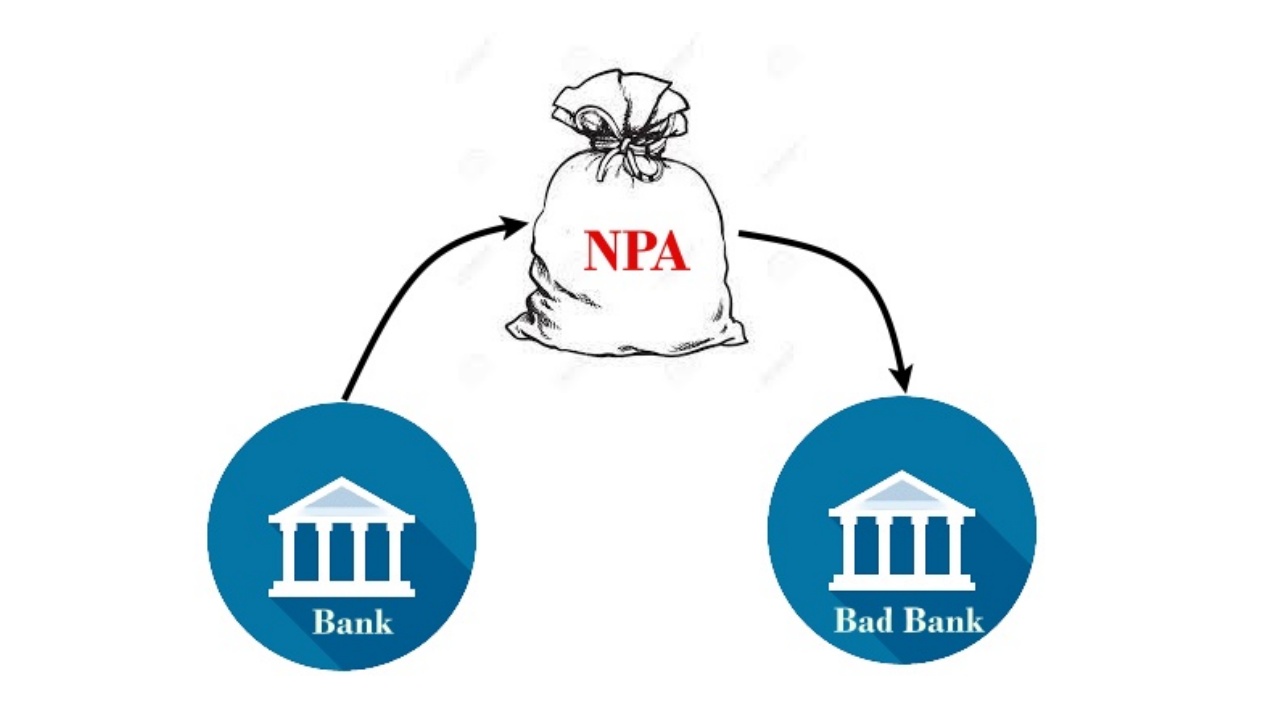

Two new companies – National Asset Reconstruction Company Ltd. (NARCL) and India Debt Resolution Company Ltd (IDRCL) – will soon commence operations. Together, the twin corporates constitute a new ‘bad bank’. An attempt to explain what is a ‘bad bank’ and why it is not a bad idea after all.

NARCL will ‘buy’ some difficult to recover loans – in short ‘bad loans’ – from banks and engage IDRCL as its recovery agent. At present, 15 loans worth Rs.50,335 crore are proposed to be transferred to NARCL by March 31. More will also get transferred in due course.

When a bank loan/advance for which repayment of any due instalment of principal or due amount of interest is not cleared within 90 days of ‘due date’, it is called ‘Non performing Asset’ (NPA) of the lending bank . (For agricultural loans it is ‘within two crop seasons for short duration crops’ or within ‘one crop season for long duration crops’.)

If an NPA default continues beyond one year of due date the NPA is called ‘Sub-standard assets’. If an NPA default continues beyond two years of due date the NPA is called ‘Doubtful assets’. If auditors find that an NPA is due to incurable default, they classify the NPA as ‘Loss Assets’.

Does anyone expect that each and every business will always make profit? No. Likewise, money lending is also a business and a bank runs the risk of some loan or part of it or interest not coming to it. A bank hoping to lend only to 100% safe borrowers will not run for long because 100% safe borrowers generally don’t need to borrow or are disinclined to borrow!

Past efforts for resolution of stressed assets seemed to start showing results: After reaching a peak of 11.5 per cent at end-March 2018, the gross NPAs of scheduled commercial banks came down to 8.5 per cent by end-March 2020 and further reduced to 6.9 per cent by September 2021.

In July 2020 and December 2020, when the pessimistic scare about the adverse fallout of the pandemic on economic growth was high, the RBI had assessed gross NPAs to rise to the high range of 13.5 -14.8 percent by September 2021. But it is only 6.9 per cent. I am sure RBI is too happy to be wrong!!

The economy is on a rebound and the scare is dwindling. As per latest assessment (December 2021), RBI states that the gross NPAs may rise to 8.1-9.5 per cent by September 2022, with special stress coming from micro, small and medium enterprises. I am sure RBI would be too happy to be wrong again!!

Net NPA were 2.8 per cent by the end of March 2020 and declined to 2.3 per cent by September 2021.

The difference between gross and net NPA is the amount for which banks have already adjusted their profit and loss accounts and balance sheets by making provisions for bad and doubtful debts.

A Bad Bank buys bad loans from banks and takes over the risk of its full or partial non-recovery. So a bad bank is a rescuer, an angelic white knight that offers to relieve the banks from the pain of pursuing bad loans.

In addition to segregating or removing the bad assets from other banks’ balance sheets, a bad bank allows for specialized management of the problem of bad debts so that the banks can focus on fresh lending.

Mellon Bank in USA first created a bad bank named Grant Street National Bank in 1988 to which the bad loans of Mellon Bank of $1.4 billion were sold at $1b, 57% of face value. New bank had no other banking function. It did not lend and it took no public deposits. Its sole purpose was to pursue recovery of bad loans. To finance the acquisition, it issued equity &preference shares and special bonds. Mellon shareholders were issued shares in both the good and bad banks on a one-for-one basis as a dividend.

Fortunately, the experiment was successful. Grant Street’s early investors made handsome profits and the bank was dissolved in 1995 after repaying all bondholders and meeting its objectives.

India had experimented with a bad bank in 2004 with questionable success. IDBI was converted from a statutory corporation to a banking company IDBI Bank and its NPAs of Rs.9000 crore were transferred at book value to a newly created Stressed Assets Stabilisation Fund, which was financed by the government through special securities.

In 9 years, the Trust could recover only Rs.4071 crore. (Report of the Comptroller and Auditor General of India No. 5 of 2014). IDBI Bank required another bail out by Life Insurance Corporation.

Taking lessons from this IDBI experiment, the new bad bank is in the form of NARCL – majority-owned by public sector banks as the Principal and IDRCL – majority owned by private banks – as Agent. This is a novel idea and we need experimenting with new ideas, new institutions. NARCL will acquire the identified NPA accounts from banks and IDRCL will handle the debt resolution process as an Agent of NARCL.

In the first phase, at least 15 accounts worth Rs 50,335 crore will be transferred to the proposed bad bank by March 31. Initially, an estimated Rs.2 lakh crore worth of bad assets were planned to be transferred but many bad loans have already been resolved and NPAs have actually come down in absolute terms and as per cent of total lending.

Two stage separation of the management of the recovery agent from the management of the lending bank means the recovery agent can be more independent and ruthless and ruthless, free from any nexus that may possibly exist between the defaulting borrower and lending bank staff. The nexus and laxity, if there is any, will get exposed.

An internal bad bank does not address the risk of collusion and negligence on the part of lending bank staff that results in impairment of underlying securities.

The bank credit is showing very encouraging signs of revival. As per latest data, total outstanding bank credit was Rs.111.6 lakh crore as on November 19, 2021 compared to Rs.104.3 lakh crore as on November 20, 2020, a 7 per cent annual growth in credit disbursal. Credit-deposit ratio was about 70 per cent till September 2021. With outstanding bank credit being about 50 per cent of GDP and 70 per cent of outstanding bank deposits, there is further scope to enhance bank lending.

Bank credit at about 50% of GDP is rather low considering the massive financing needed to boost growth and development. Credit-driven growth is now a give imperative in present international scenario. So banks need to be empowered and facilitate to INCREASE LENDING. Expeditious resolution of NPAs is necessary to boost bank managers’ confidence. Deterrent action against wilful defaulters does not lead to collateral damage of risk aversion in banks to lend.

Government is stepping in to help the banks focus on fresh lending. NARCL will purchase bad loans by giving15% cash and 85% in securities backed by government guarantee The government approved a 5-year guarantee of up to Rs,30,600 crore for security receipts to be issued by NARCL

The pandemic crisis is unprecedented and has disrupted economies all over. However, all sectors are not adversely affected. Indian economy is not a single engine aircraft. For last few months, we are witnessing a steady rebound in economic activity.

Thanks to liquidity infusion measures taken by the RBI as part of ameliorative measures to deal with the pandemic induced economic crisis and steady inflow of foreign funds, the domestic financial system is flush with excess liquidity. A Bad Bank may be easier to capitalise than anytime before.

As said before, it is a novel experiment in institution building with stronger chances of success.

Bad Bank is not a bad idea -Dr. Subhash Chandra Pandey